Key Takeaways

- Personal injury protection pays medical bills, lost wages, and essential services after a crash—regardless of who is at fault.

- PIP is mandatory in some no-fault states, optional in others, but always provides immediate financial support.

- It does not cover pain and suffering, emotional distress, or high costs that exceed policy caps.

- Meeting state injury thresholds can allow claims beyond PIP against at-fault drivers.

- At Frantz Law Group, we can help you maximize recovery—from navigating PIP claims to pursuing full compensation in complex personal injury cases.

Understanding Your Essential Auto Insurance Safety Net

Car accidents are often unexpected and can be very chaotic, causing pain, confusion, and immediate concern about mounting insurance claims, medical bills, and lost income. In those moments, your mind may be filled with questions like “How will I pay for urgent care?” “How will I cover daily expenses if I can’t work?”

That’s where personal injury protection (PIP), often called no-fault insurance, acts as your first line of financial defence, covering essential costs regardless of who caused the crash.

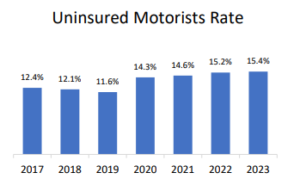

According to the Insurance Research Council, approximately 15.4% of U.S. drivers were uninsured as of 2023, highlighting the critical importance of first-party coverage like PIP while claims are under investigation.

Source: Insurance Research Council

In this article, we’ll explain personal injury protection (PIP), what it covers, and how our experienced personal injury attorneys can help you when PIP isn’t enough to cover your losses fully or when insurance disputes arise. Whether you’re in a no-fault state or simply considering robust coverage, understanding your rights and options is a crucial first step in protecting yourself.

What is the Meaning of Personal Injury Protection (PIP)?

Personal Injury Protection is a type of car insurance coverage that helps you pay for medical expenses, lost wages, and other accident-related costs, not just for you, but also for your passengers. Its key feature is getting the payout regardless of who caused the accident.

This no-fault feature means that even if another driver is at fault, you don’t have to wait for them to accept responsibility before your bills start getting paid. That’s why it’s commonly referred to as no-fault insurance in states where PIP is required.

In traditional fault-based systems, you typically file a claim against the at-fault driver’s insurance, which can take months to resolve. But with PIP, you file the claim with your own insurance company for your accident-related expenses. This allows for:

- Faster access to medical benefits and wage replacement

- Less immediate legal wrangling

- Quicker financial relief during recovery

For Instance, Section 627.736 of the Florida Statutes requires that all drivers carry a minimum of $10,000 in PIP to cover medical and disability benefits and $5,000 in death benefits, regardless of fault.

While the laws vary state by state, more than a dozen states—including NYC, Florida, Michigan, and New Jersey—have no-fault systems where PIP is mandatory. In other states, it may be optional, but still available for additional protection.

What Does Personal Injury Protection Typically Cover?

PIP provides critical financial support after an auto accident, including:

Medical Expenses

PIP’s primary benefit is covering reasonable and necessary medical treatment resulting from the accident. This may cover:

- Doctor visits, hospital stays, and surgeries

- Ambulance and emergency services

- Rehabilitation, physical therapy, and chiropractic care

- Prescription medications and medical supplies

- Diagnostic tests such as X-rays, MRIs

These medical and rehabilitation expenses cover care within a defined period (typically up to three years post-accident) and must meet the criteria of reasonableness and necessity.

Lost Wages

If your injuries prevent you from working, PIP often reimburses a portion of your lost income. Many states impose limits or waiting periods:

- Coverage is usually around 80% of your average weekly wage, up to a state-defined cap

- For instance, Texas requires insurers to pay up to 80% of lost wages within three years of the accident.

- Some states, such as Michigan, set caps ranging from $50,000 to unlimited, depending on policy levels.

Essential Services

PIP may cover services you’re no longer able to perform due to injury, such as:

- House cleaning, lawn care, childcare, laundry, grocery runs

- These are often called replacement services or essential services

- For instance, Washington State offers benefits up to $200/week (up to $5,000 total) for necessary non-family services.

Funeral and Death Benefits

In the tragic event of a fatal accident, many states’ PIP policies extend benefits to survivors:

- Funeral and burial costs up to state-mandated limits—for example, $2,000 in Washington State.

- Certain no-fault states also provide survivor economic loss benefits as part of PIP coverage. For instance, Section 65B.44 of the Minnesota Statutes provides survivor benefits of up to $500 per week for a maximum of one year, within an overall $20,000 cap.

Is PIP Worth It? Benefits and Considerations

Immediate Financial Relief

PIP provides a crucial safety net right after a crash, covering medical bills, lost income, and household services without needing to prove fault. That means immediate support while you focus on recovery, not paperwork.

Coverage for You and Your Passengers

PIP protects everyone in your vehicle at the time of the accident, regardless of who caused it. This no-fault protection ensures all covered parties receive benefits under the same claim.

Optional Vs. Mandatory States

- In about 12 U.S. states, (including Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah) PIP is required by law as part of no-fault insurance system.

- In other states, such as Washington, insurers must offer PIP, but if a policyholder decides to opt out, he must do so in writing.

- Even where it’s optional, adding PIP provides valuable peace of mind, covering upfront costs without delay.

Limitations of PIP

- No Compensation for Pain and Suffering: PIP typically covers only economic damages such as medical expenses, lost wages, and essential services. It does not compensate for non-economic damages like pain and suffering, emotional distress, or reduced quality of life.

- Coverage Limits: Most PIP policies have monetary caps on benefits:

-

- Florida mandates 80% coverage of necessary medical expenses up to $10,000 per incident.

- Michigan allows for multiple tiers of coverage, ranging from $50,000 to unlimited lifetime medical benefits, under the PIP Choice system.

Is Personal Injury Coverage Worth It? When Frantz Law Group Can Help

Beyond PIP: Seeking Full Compensation

While personal injury protection provides fast coverage for medical bills and lost wages, it’s only the first layer of financial protection.

In severe and catastrophic injury cases, costs can quickly pile up and exceed PIP policy limits. Moreover, PIP does not pay for non-economic damages such as:

- Pain and suffering

- Emotional distress

- Loss of enjoyment of life

In such cases, a personal injury claim or lawsuit against the at-fault party becomes the only viable path to securing full and fair compensation.

For instance, under Section 627.737 of the Florida Statutes, individuals who sustain serious injuries may pursue damages beyond PIP limitations if they meet the legal threshold for significant and permanent injury.

How Frantz Law Group Steps In

-

- Navigating PIP Claims: Insurance paperwork, claim timelines, and disputes can quickly become overwhelming. Our attorneys can:

- Explain your PIP benefits clearly

- Ensure claims are filed accurately and on time

- Advocate for complete and timely payment from insurers

- Navigating PIP Claims: Insurance paperwork, claim timelines, and disputes can quickly become overwhelming. Our attorneys can:

- Maximizing Full Recovery: When PIP limits are exhausted, or when you need compensation for pain and suffering or other damages PIP doesn’t cover, our team of legal experts at Frantz Law Group:

-

- Pursue comprehensive personal injury claims

- Negotiate with the at-fault party’s insurer for fair settlements

- Litigate in court when necessary

- Maximize your settlement claims

- Handling Complex Cases: From disputes over fault to negotiating with multiple insurers, we handle the complexities so you can focus on recovery. Our team of legal experts has a proven track record and has received honorable awards across the country.

Your Protection with Frantz Law Group

Personal injury protection is a valuable part of auto insurance that can provide immediate financial support. However, it has limitations on payouts and does not cover non-economic losses.

Many states allow you to step outside the no-fault system when your injuries meet statutory thresholds. For example:

- Section 627.737 of the Florida Statutes allows lawsuits for significant or permanent injuries.

- Section 5102 (d) of New York Insurance Law defines serious injuries that qualify for claims beyond PIP.

At Frantz Law Group, we prioritize justice for our clients and focus on securing the rightful compensation you deserve. If you’ve ever been injured in a motor vehicle accident, whether or not you have PIP coverage, our attorneys can:

- Review your PIP benefits

- Explore your legal options beyond PIP

- Fight for the full compensation you deserve.

Contact us today for a free, no-obligation consultation to understand the technicalities of your case. We advance all case costs, and you pay us nothing unless we win or secure a judgment in your favor.